Introduction to Spinoff Investing

In this write-up I will be discussing a spinoff stock. Therefore, I will first provide a brief overview of spinoffs for those who are not familiar with them. If you already know what a spinoff is, what makes them attractive for investors, and how to spot the ones that are likely to outperform, you can skip to the “WBD Investment Thesis” section.

Spinoffs are subsidiaries of listed companies that have been distributed as a stand-alone public business to shareholders. Historically, they have been fertile ground for investors hunting for mispriced stock. A Penn State study covering spinoffs from 1963 to 1988 found that spinoffs outperformed the S&P 500 by about 10% in their first 3 years of trading. More recently, from 2003 to mid-2021, returns for the Bloomberg Spin-Off Index more than doubled those of the S&P 500.

Source: BCG

There are a few reasons for the outperformance of spinoffs. First, investors who receive the spinoff often times don’t want it for a variety of reasons. The new spinoff may be too small for institutional investors to own, be in an unattractive industry, or pay a lower dividend than the parent company. As a result, spinoffs’ shares are often sold off without regard for price or value. At the same time, management teams at spinoffs are typically more incentivized to make the business perform well as they often receive generous stock options and equity in the new company. They may also have greater operational freedom to undertake value-creating initiatives.

However, as you can see from the chart above, there is a great deal of dispersion among spinoffs, (which is good for stock pickers). It can therefore be very rewarding to know how to pick the best of the bunch. In his book, “You Can be a Stock Market Genius”, famous value investor Joel Greenblatt (who from 1988 to 2004 generated returns of 30.8% per year) outlines how to identify the most attractive spin-offs. He argues you need to look for situations where: 1) Receiving investors don’t want the spinoff. This creates the excessive uneconomic selling resulting in the undervaluation. 2) Insiders want the spinoff. Insider purchases create an alignment of incentives and is a sign that insiders (who usually know more about the company than outside investors) believe that the stock is cheap. 3) A previously hidden investment opportunity is uncovered by the spinoff (like a cheap stock, a great business, or a leveraged risk/reward situation). Such an investment opportunity may have been hidden to investors and the spinoff helps reveal the new opportunity. With that framework in mind, I will argue why I believe that Warner Bros. Discovery is an attractive spinoff situation.

WBD Investment Thesis

As discussed above, according to Joel Greenblatt, the most attractive spinoff situations often share three key characteristics: 1) receiving investors don’t want it, 2) insiders want it, and 3) a previously hidden investment opportunity is uncovered. I will first show how Warner Bros. Discovery (WBD) has many of these characteristics, making it an unusually attractive spinoff. I will then go over how I think about valuation and some of the risks involved in the situation.

Receiving investors don’t want the spinoff

On April 8, 2022, AT&T spun off WarnerMedia and merged the business with Discovery to become WBD. Under the terms of the deal AT&T received $43 billion in cash and debt relief of about $1.5 billion (assumed by WBD) and AT&T shareholders received 71% of the stock in WBD (worth about $59 billion at the spinoff date).

However, for several reasons, many of AT&T’s investors did not want the WBD spinoff. First, AT&T paid a dividend yield of about 6% at the time of the spin. Seeing as WBD does not pay a dividend, many of those investors who owned AT&T for the dividend, or funds with a mandate to own only dividend stocks, likely sold WBD without regard for value.

Second, WBD is highly leveraged, which is likely scaring off many investors (I will argue why I don’t see the leverage as an issue in the “Risks” section). In 2Q22, WBD’s first quarter as a stand-alone company, the company had approximately $49 billion of net debt and about $9.6 billion of adjusted EBITDA, or a net debt to EBITDA ratio of about 5x. This makes investors nervous given the potential for a severe recession in 2023 and that WBD is fairly reliant on advertising revenues, which are highly cyclical (c.24% of LTM revenues).

Finally, a large portion of AT&T shareholders were retail investors – an estimated 45% to 50%, according to Barrons. Many of these investors appear to not have wanted the WBD spinoff. Retail investors now own just c.23% of shares in WBD, based on WallStreetZen ownership data (although this isn’t a perfect comparison as AT&T investors received only 71% of the shares in WBD). There are a few reasons why retail investors might have sold WBD. One reason is that retail investors are unlikely to have had the time or expertise to analyse the stand-alone company. They may also have bought AT&T solely for the dividend or could have been frightened by the stock sell-off (WBD has fallen by 61.26% since spinoff) or high debt level.

Insiders want the spinoff

Since WBD was listed in April, insiders have been actively buying (see chart below). Usually (although not always) this a sign that the stock is undervalued.

Source: Dataroma

Furthermore, the management team seems to be highly incentivized for the company to perform well. In 2021, CEO David Zaslav was granted 14.7 million shares (equivalent to c.1% of shares currently outstanding) in a one-time option grant estimated to be worth nearly $203 million. The strike price of those options is between $35.65 and $43.33, meaning they are worthless unless the stock goes up by more than 3.5x. He also already owns 7.5 million shares.

As a final sign that insiders want the spinoff, major Discovery shareholders John Malone and Advance/Newhouse (both veterans in the media industry) gave up their preferred voting shares as part of the merger. That these shareholders were willing to give up their voting power to make the deal go through is a very positive sign.

A previously hidden investment opportunity is uncovered by the spinoff

It is quite likely that the combination of WarnerMedia and Discovery has created a situation in which the combined companies are worth far more than the two separately. To explain, it is important to understand the unit economics of the streaming business. Let’s take Netflix as an example. Netflix has about 220 million customers and generates about $12 in revenues per customer per month. On the cost side, it spends about $7 in content, $1 in marketing, and $2 in other operating expenses per customer per month. Therefore, Netflix earns about $2 in operating income per customer per month or a c.20% operating margin.

As you can see, content costs are by far its most important costs, which makes sense. The key thing to keep in mind is that content costs are to a large degree fixed costs – so if Netflix were to double its customer base, it could theoretically spend only $3.5 in content per month. As a result it, it could either earn $5.5 per customer in operating income (46% operating margin) or pass those costs savings to consumers by charging only $8.5 per customer (this is the so-called Scale Economics Shared model popularized by Nick Sleep).

So, the name of the game is clearly scale. In this sense, I believe the WarnerMedia Discovery combination will help the duo achieve that scale. The combined company will be spending more than $20 billion per year on blockbuster content that attracts customers (through the likes of DC and HBO) while supplementing this with low-cost unscripted content that helps increase user engagement and reduce churn (through the likes of HGTV and TLC). WBD will also be able to draw from a remarkable scope and depth of content across genres ranging from comedies, sports, news, documentaries, reality TV, and kids. Importantly, this legacy content allows WBD, and other established media companies such as Paramount, to spend almost half of what Netflix spends as a percentage of revenues as they don’t need to come up with hits every year to keep audiences engaged (see chart below).

Source: Annual reports, Author estimates

From a more financial perspective, I believe that the debt that WBD took on as a result the merger has created an attractively leveraged risk/reward situation in the stock. As I will argue in the “Valuation” section, I believe the company as a whole (debt and equity) is probably worth about 2 times what is currently implied by market. This means that the equity alone is likely worth about 4.5 times the current market cap. On the flip side, the 50% enterprise value discount leaves enough of a margin of safety to make the situation attractive on a risk/reward basis.

Valuation

Management is guiding towards $12 billion in EBITDA in 2023 after it extracts about $2.5 billion of synergies from the merger in 2023. As an aside, management’s total synergy estimate is more than $3.5 billion ($0.5 billion in 2022, $2.5 billion in 2023, and $0.5 billion in 2024). This may prove to be conservative. John Malone recently stated that he expected cost and revenue synergies to “easily” exceed $3 billion to $4 billion per year. It is also worth noting that when Discovery acquired Scripps, Discovery generated >$1 billion in synergies, 3x the amount originally forecasted. In addition, that $12 billion in EBITDA includes $1.9 billion of EBITDA losses from the DTC segment, which reflect an investment in growth and are expected to turn to profits in 2025. If one were to add those losses back, we would get about $14 billion in EBITDA for 2023.

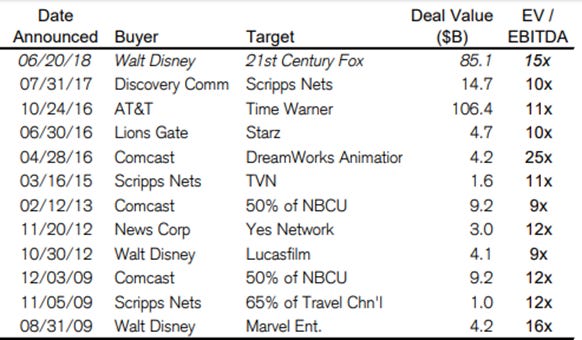

Public peers trade at between 9.4x and 22.5x NTM EV/EBITDA (see chart below). Excluding Netflix, WBD’s peers typically trade in the range of 9x and 11x NTM EV/EBITDA. Private transactions in the space have also typically fallen within this range (see table below). Applying a 10x NTM EV/EBITDA multiple to $14 billion in EBITDA would result in a $140 billion enterprise value for WBD. Subtracting its c.$50 in net debt gets you to a c.$90 billion equity value (or a 4.5x from its current market cap of c.$20 billion). As an aside, WarnerMedia’s assets were valued at close to $80 billion in the merger and Discovery’s enterprise value prior to the merger was c.$40 billion.

Source: Koyfin

Source: Credit Suisse

For those of you who don’t like EBITDA, management is targeting 33-50% FCF conversion rate in 2023. Taking the mid-point of that range, the current market cap of $20 billion implies about a 4.2x forward P/FCF multiple, or 3.6x if you strip out the DTC segment losses. My valuation of $90 billion implies about an 18.8x P/FCF, or 16.1x if you subtract the DTC segment losses. For reference, the company expects to reach a 60% FCF conversion rate in the long-term.

Risks

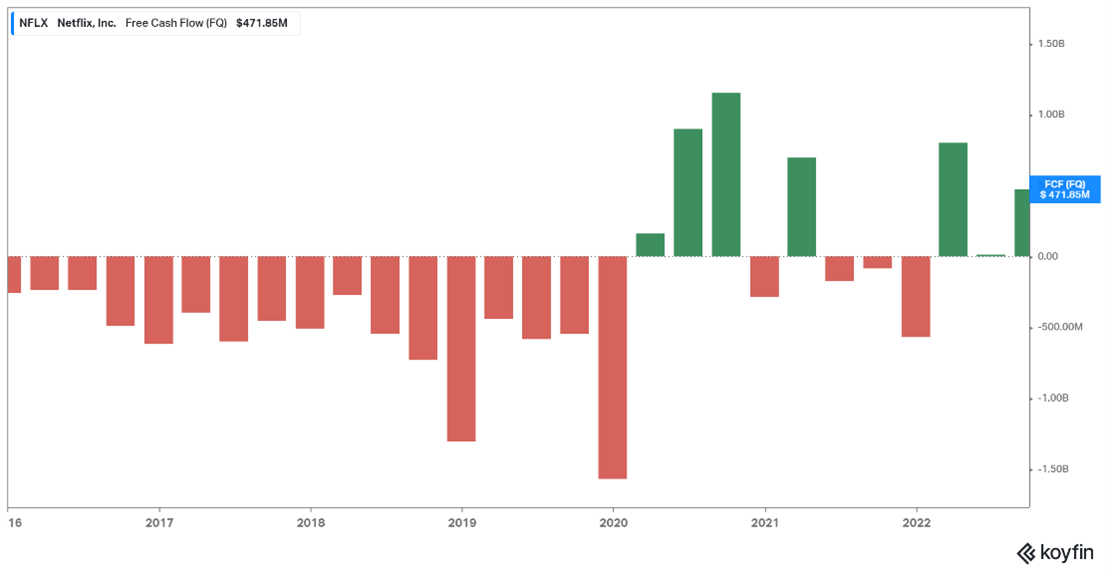

Leverage. The most obvious risk here is the high debt level. There are few reasons why it doesn’t worry me so much. First, the debt is relatively long-term (14+ years average maturity) and 91% of it is fixed-rate, which insulates WBD from interest rate rises. Second, management is committed to paying down debt quickly and expects to hit its long-term gross leverage target of 2.5x to 3x by the end of 2024. Third, and probably less well understood, in the movie business, cash content expenses are front loaded while revenues are generated over time. In a difficult economic environment, this gives movie studios significant leeway to cut costs and generate significant cash flow. For example, in 2020, facing the potential economic fall-out of the pandemic, Netflix cut its spend on content by almost $1 billion per quarter on a YoY basis to better manage its cash flow (see chart below). Within a few quarters it went from burning more than $500 million in cash per quarter to generating $1 billion in cash (see chart below). WBD has more than $20 billion in content each year from which it could pull back spending if it needed to. In addition, it has a $6 billion in a revolving credit facility it can draw from unconditionally if the company deems this to be necessary. I think this should help mitigate the short-term liquidity concerns. Fourth, David Zaslav is an experienced media executive who pulled off a similarly leveraged acquisition in Discovery’s acquisition of Scripps in 2018.

Source: Hayden Barnes

Source: Koyfin

Decline in linear TV. The second most obvious risk to point out is the decline of linear TV. This segment accounts for more than 50% of the company’s revenue. The rate of decline for US pay-TV has accelerated since 2018 and in Q3 2022 reached 6.2%. I believe the company should be able to offset this via the growth of its streaming business. Management is targeting 130 million subscribers (it has 95 million subscribers as of in 3Q22). In fact, David Zaslav has previously stated that the company could reach more than 200 million DTC subscribers within two or three years of the merger and up to 400 million in the long term. At MoffettNathanson's 8th Annual Media and Communications Summit, Zaslav also revealed that Discovery makes about $6 to $7 per cable subscriber, whereas Discovery’s ad-free version of Discovery Plus generates ARPU of $7 a month and its “light ad” version generates ARPU of more than $10. Therefore, he estimates “if [they] lost a million [cable] subs, all [they would] have to do is pick up 650,000 [Discovery Plus] subs in order to be making more money.”

AI Disruption. Finally, I think the least obvious and hardest to handicap risk is the potential for AI to disrupt the media industry. To a large degree, WBD obtains its competitive advantage from the economies of scale involved in producing the high-quality content. This allows them to attract and retain a large customer base over which it can amortize its content spend. Should AI make it easier and less expensive to replicate such high-quality content, this could significantly erode WBD’s moat. However, at about 4x fwd P/FCF, I believe there is enough of a margin of safety to allow one to take the bet and see how the situation unfolds.

Disclosure: I do not have any position in the shares of Warner Bros. Discovery, Inc. (NASDAQ: WBD). I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. All content on this newsletter, and all other communication and correspondence from me, is for informational and educational purposes only and should not in any circumstances be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

I wish I saw this post earlier!